Everything about Jc Lee Realtor

Table of ContentsGetting The Jc Lee Realtor To WorkThe Main Principles Of Jc Lee Realtor All About Jc Lee RealtorJc Lee Realtor Can Be Fun For EveryoneFacts About Jc Lee Realtor Revealed

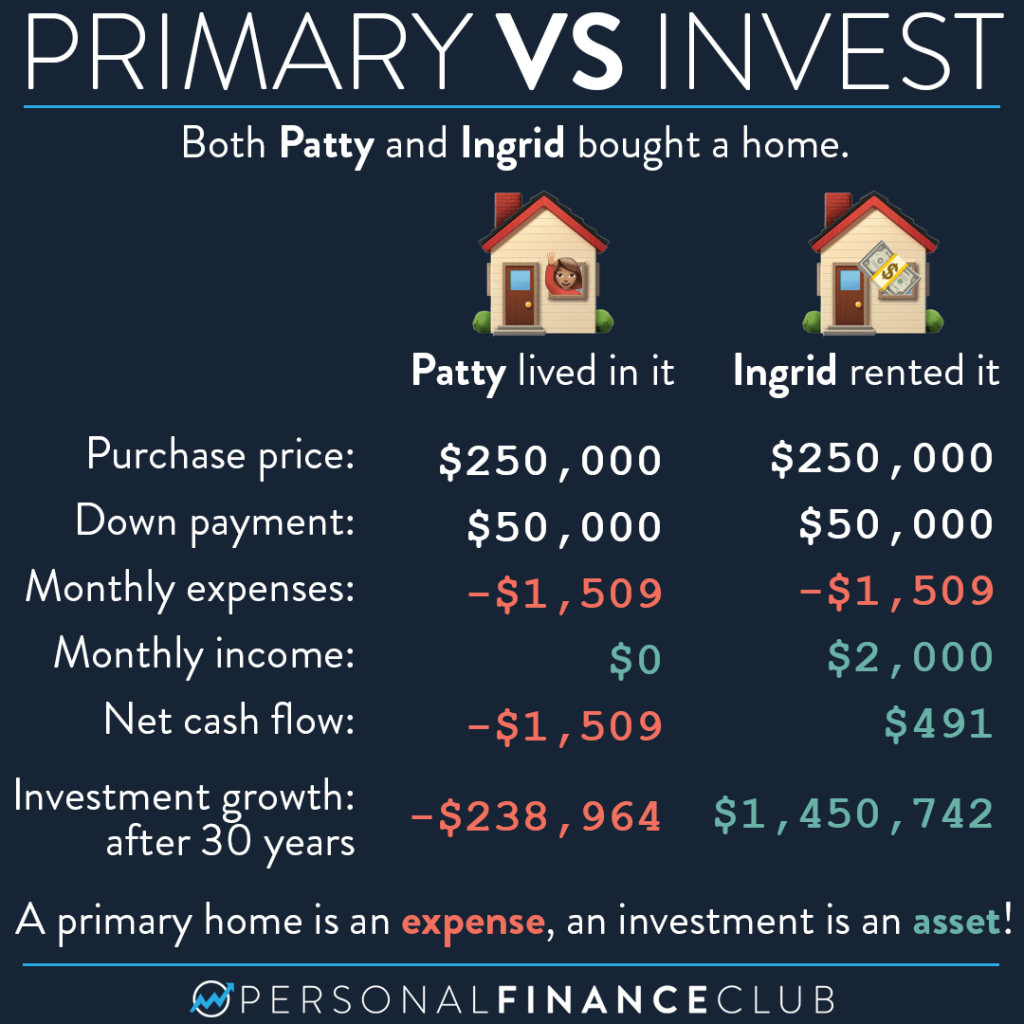

Actual estate is usually a great financial investment alternative. That's not to state the ongoing maintenance expenses you'll be responsible for, as well as the capacity for earnings voids if you are in between renters for a time. Below's what you require to know about investing in actual estate and if it's the ideal selection for you.If you can not afford to pay money for the house, at the really the very least, you should have the ability to afford the mortgage repayments, even without rental earnings. (Utilize our calculator below to help you make a decision.) Assume about it: With occupants, there can be high turn over. You may additionally experience a time where you have no renters in all for the home.

Jc Lee Realtor - Truths

, which will certainly cost you cash in the long run. Frequently, it is simpler to go via a rental business and have them take care of points like fixings and lease collection.

Especially if you don't have time to do everything that needs to be done at your residential property, making use of an agency is a good choice. You require to value your rental building to make sure that all of these charges as well as various other costs are totally covered. In addition, you should take the initial couple of months of surplus cash and set it aside to cover the expense of repairs on the building.

You need to likewise be prepared to deal with extra expenses and also other situations as they arise, possibly with a sinking fund for the residential or commercial property (jc lee realtor). Study the Property Carefully If you are purchasing land that you prepare to sell at a later date, you need to look into the land deed thoroughly.

Be certain there isn't a lien on the home. You might additionally intend to consider things like the comparables in your area, consisting of whether the area is up-and-coming, and other outside aspects that could affect the building worth. Once you have done your research study, you need to have the ability to make the correct decision concerning purchasing it as an investment.

Jc Lee Realtor - Questions

You may make money on your investment, however you might shed money. Points may alter, and also a location that web you believed may boost in worth could not actually go up, and vice versa. Beginning Small Some investor start by acquiring a duplex or a home with a basement house, after that living in one device as well as renting the various other.

Property wholesaling may likewise be one method to begin buying property without a great deal of up front funding. Furthermore, when you set up your budget, you will desire to ensure you can cover the whole month-to-month home mortgage repayment and also still live conveniently without the additional lease repayments being available in.

Instead, they possess financial debt safeties, which are riskier. Crossbreed REITs incorporate equity and also home mortgage REITs. Just how do you spend in real estate? You can take several paths to obtain begun in real estate. One would certainly be to buy a multi-unit building and rent the other systems. You might likewise purchase a single-family home to rent.

You might also rent rooms in your own house to accumulate the funds to buy anonymous more realty. REITs also allow you to purchase realty, but without having to conserve up the money to purchase a building or maintain one.

Our Jc Lee Realtor PDFs

You have a lot of options when it involves purchasing property. You can purchase a single-family house, rent it out and gather monthly rental fee checks while waiting on its worth to rise click over here high adequate to produce a large revenue when you market. Or you can acquire a little strip mall and also collect month-to-month rental fees from salon, pizza restaurants, cushion shops and other organizations.

When you get right into a REIT, you acquire a share of these buildings. It's a bit like investing in a shared fund, just rather than supplies, a REIT bargains with realty. You can generate income from a REIT in 2 ways: First, REITs make regular dividend payments to financiers.

You can spend in a REIT simply as you would certainly buy a supply: REITs are listed on the significant supply exchanges. The National Association of Property Financial investment Trusts claims that concerning 145 million united state locals are spent in REITs. Residential Characteristic Sinking your money into investment properties can also prove financially rewarding, though it does require some job.

Jc Lee Realtor Can Be Fun For Everyone

You can reduce the odds of a negative investment by investigating local areas to find those in which residence values often tend to increase. You should likewise collaborate with property agents and various other professionals who can you show historic admiration numbers for the communities you are targeting. You will certainly need to bear in mind place.